How Many Native Americans Where Slaughtered During the Gold Rush

American Hartford Gold Review

Gold IRAs are useful for diversifying retirement savings in a tax-deferred account. Experts at American Hartford Gold assist consumers throughout the precious metals buying and selling process. The company delivers quality customer service, industry experts, extensive historical investment data and current market research. American Hartford Gold uses a three-step process to simplify and set up a Gold IRA.

Pros

- High priority placed on customer service and compliance

- Buyback program reduces liquidation fees

- Complete disclosure of costs before final sale and client exclusive buyback program

Cons

- No prices included in the online catalog

Gold and other precious metal IRAs are an investment and carry risk. Consumers should be alert to claims that customers can make a lot of money in these or any investment with little risk. As with any investment, you can lose money and past performance is not a guarantee of future performance results. Consumers should also obtain a clear understanding of the fees associated with any investment before agreeing to invest.

How to Open an American Hartford Gold IRA

To open a Gold IRA, submit the form provided on American Hartford Gold website or call the number provided on the site. A Product Specialist will assist you in completing the paperwork to open a self-directed IRA, which is required for this type of retirement savings account. Next, initiate a Gold IRA rollover or funds transfer to the new IRA. You can transfer many types of retirement savings accounts to an American Hartford Gold Precious Metals IRA, such as traditional and Roth IRAs, a 401(K), a 403(B) among others.

Once you fund the Gold IRA, speak to an account executive at American Hartford Gold for guidance selecting IRS-approved precious metals for your account. You can buy gold, silver, platinum or palladium.

You can liquidate a Precious Metals IRA after the age of 59.5 years and either cash-out or take possession of the physical metals. American Hartford Gold recommends holding precious metals for at least five to ten years.

| American Hartford Gold Top Investments for Precious Metals IRAs | |

|---|---|

| Investment | Characteristics |

| American Eagle Gold Coin | Minted only with gold mined in the U.S.; easiest to buy and sell in the U.S. |

| American Buffalo Gold Coin | 24 karat, purest gold coin from the U.S. Mint. Carries a face value but trades at a higher value. |

| Canadian Maple Leaf Gold Coin | At .99999 purity, contains virtually no base metal. Gold mined in Canada. |

| 1 oz. Gold Bar | Includes MintMark SI security feature to prevent counterfeiting. |

| Valcambi CombiBar Gold or Silver Bar | Manufactured with breaking points and can be divided with 50 or 20 divisions per ounce. |

| American Eagle Silver Coin | The only silver coin allowed in IRA accounts, $1 face value, trades higher based on silver content. |

| Canadian Maple Leaf Silver Coin | 99.99% pure silver, holds face value for transactions but typically valued much higher for investment. |

| 10 oz. Silver Bar | .999 pure, various designs available from a variety of approved mints. |

American Hartford Gold Costs

American Hartford Gold does not charge fees to set up a Gold IRA or rollover a retirement account to a Gold or Precious Metals IRA. Shipping precious metals to the depository is always free and includes insurance and tracking.

American Hartford Gold provides no specific pricing information for account maintenance fees on the company website. Gold IRA storage fees are often waived for up to three years or longer depending on the size of the Gold IRA account and the number of precious metals being stored. American Hartford Gold does not have a minimum Gold IRA contribution amount.

You may find promotions on American Hartford Gold website, like $1,500 in free silver and up to three years with no account maintenance fees.

Storage Options for American Hartford Gold

Since Gold IRAs hold physical precious metals, the bars, coins or bullion are stored in an IRS-approved depository. American Hartford Gold recommends using a widely-known depository such as Brinks Global Services, International Depository Services (IDS) or Delaware Depository Service Company which have locations nationwide. You can elect to keep your precious metals segregated from others stored at the depository.

Depositories charge a storage fee. Storage costs we found through research average around $75 per year but could be more or less depending on the value of your gold.

American Hartford Gold BuyBack Commitment

Not all Gold IRA companies offer a buyback plan, but American Hartford Gold does. The BuyBack Commitment provides a way for their customers to sell their precious metals while avoiding additional fees for the fast three-step liquidation process. American Hartford Gold arranges for the shipment of the gold or other precious metals then issues a payment. Check with your account executive to see if you can take advantage of the BuyBack Commitment. If you are eligible, you can save money on fees with added convenience.

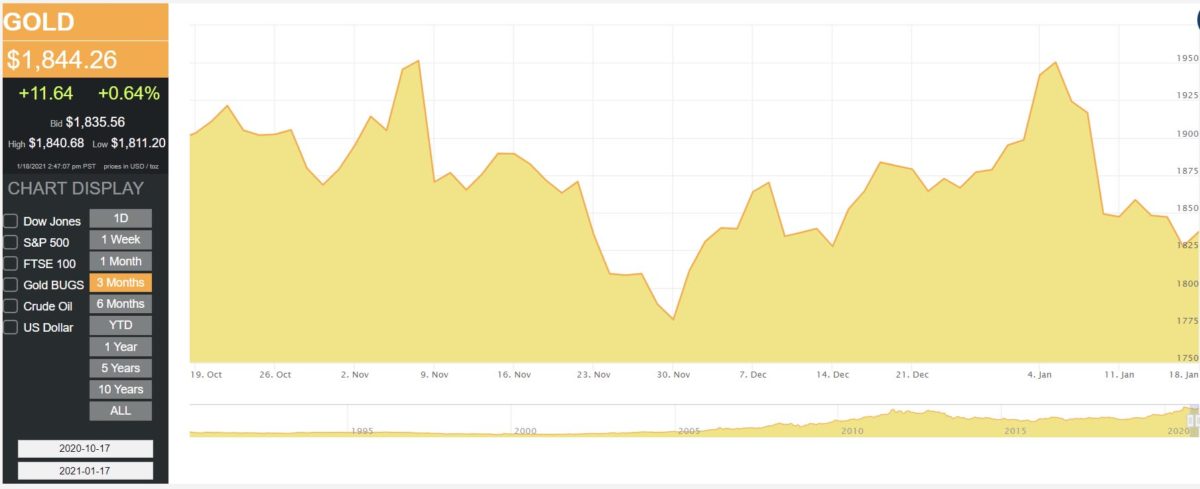

Interactive Chart Screenshot, Source: American Hartford Gold

American Hartford Gold IRA Customer Support

As a testament to their customer service, you will find plenty of general information about Gold IRAs on American Hartford Gold's website. If this is a new type of investment for you, the company makes precious metals catalogs available on the site, along with these resources:

- Expert analysis and fact sheets about gold and silver

- A wealth of gold market news articles

- Price charting tools for gold, silver and platinum

- Real-time gold, silver and platinum prices

You are always welcome to call to ask questions, use the online chat to communicate with a representative or complete a brief form on the website to receive a free investment guide via email. The guide has answers to common questions about purchasing precious metals and establishing a Gold IRA.

American Hartford Gold Complaints

American Hartford Gold is a trusted leader in the precious metals and Gold IRA industry receiving an "A" rating from the nonprofit Business Consumer Alliance. It is accredited on the Better Business Bureau website, where it has an "A+" rating. ConsumerAffairs also accredits the company and customer reviews average 4.7 out of 5 stars. American Hartford Gold has a 5-star Trustpilot rating and a 9.6 out of 10 TrustScore rating based on customer reviews.

The majority of complaints we saw against American Hartford Gold revolved around the fluctuating prices of precious metals and not the company itself.

American Hartford Gold Q&A

-

Do I own the physical precious metals in a American Hartford Gold IRA?

Yes, when you open a Gold IRA or buy and store the precious metals, you own the actual metals in their physical forms, such as bullion, coins or bars. -

Can I contribute toward an American Hartford Gold Precious Metals IRA as I would any other IRA?

Yes, you can purchase more gold or other precious metals at any time from American Hartford Gold to contribute to your IRA. Speak to your account executive or a product specialist to learn about annual contribution limits. -

How will I know if my Gold IRA is performing well at American Hartford Gold?

You will receive timely, accurate information about your Gold IRA performance by talking with an account executive or product specialist. You also receive regular account value statements and can view real-time gold, silver and platinum price charts on American Hartford Gold's website. -

What are the tax advantages to American Hartford Gold IRA?

You can invest in precious metals in a Gold IRA using pre-tax or tax-deductible funds. Gold IRA gains grow tax-free, and consumers can make withdrawals from a Gold IRA without penalties at 59.5 years of age, only paying taxes on the amount withdrawn. Roth Gold IRAs are available and use post-tax dollars with no additional taxes paid upon withdrawal. -

Is there a set time frame for taking distributions from a Gold IRA?

IRAs all have required minimum distribution rules, and these rules apply to Gold IRAs. The IRS requires you to withdraw a minimum amount each year from a Gold IRA when you reach the age of 70.5 years. American Hartford Gold website has an easy-to-use tool for estimating your minimum distribution requirement.

Conclusion

Sound retirement planning is essential for a secure economic future. American Hartford Gold strives to lead clients to financial well-being by diversifying assets with Gold IRAs or precious metals purchases. The company is well positioned to inform consumers about the benefits of investing in precious metals with industry-leading experts and quality customer support.

If you are interested in contacting American Hartford Gold, you can call 877-672-6779.

How Many Native Americans Where Slaughtered During the Gold Rush

Source: https://www.retirementliving.com/reviews/the-hartford-gold-group